When buying or selling goods internationally, both importers and exporters should be familiar with a commodities exchange. A commodities exchange is a regulated market that allows for the buying and selling of commodities, such as corn, gold, or crude oil. These exchanges create contracts between buyers and sellers of the commodity at an agreed upon price, which is negotiated by experts in international trade.

Contracts

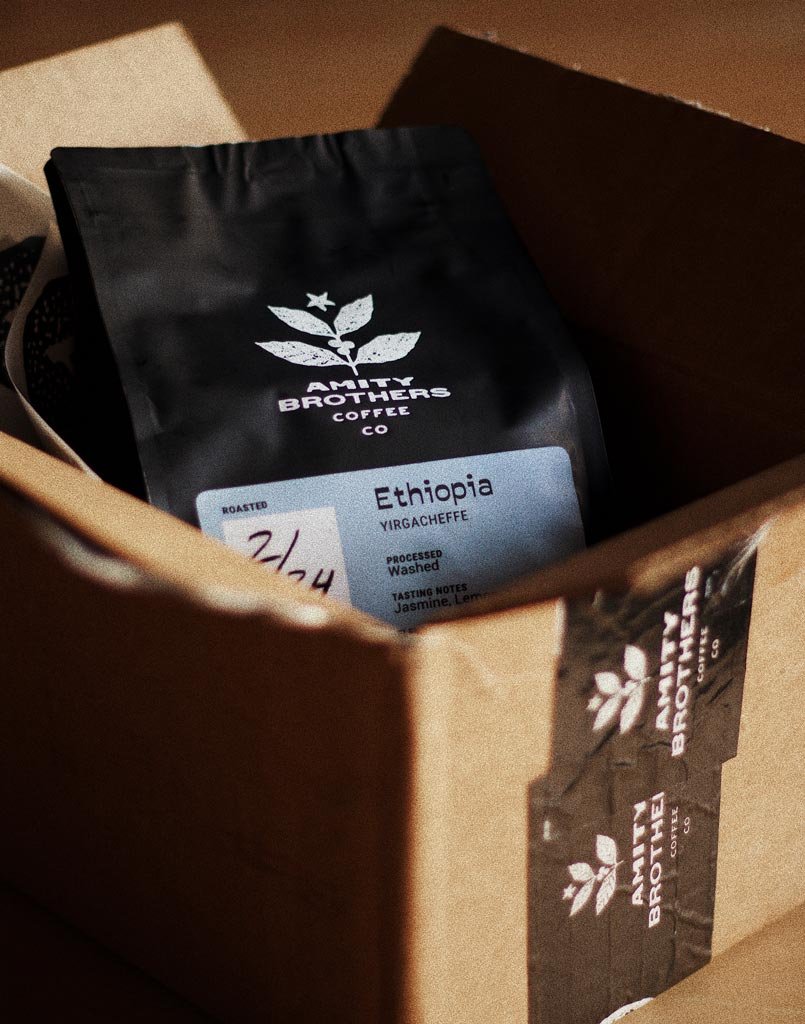

When a commodity is being traded, a contract is generated that specifies the item being traded, such as the quality, quantity, price and delivery of the item. For instance, when trading coffee, the amount of coffee being purchased is specified, along with a quantity, grade of beans, and perhaps the location where the coffee was grown. Delivery of the item in the contract is also specified, such as a delivery date and place of delivery. Other trades such as options contracts can be executed as well (contact us for details).

Role of Traders

Professional traders with experience in international trade can negotiate a contract between buyers and sellers. Typically, the sellers are the producers of a product or commodity being trade. These can include:

- Farmers (corn, soy, grain, cotton, etc.)

- Ranchers (products like beef, pork, and chicken)

- Energy companies (petroleum products like oil and gas)

- Mining companies (minerals, raw materials, precious metals)

On the other hand, buyers are often industrial companies that require the commodity to conduct their business. Examples include:

- Factories

- Food manufacturers

- Construction companies

- Clothing manufacturers

Traders can serve several roles in trading commodities: they can help to negotiate standard contracts (outlined above) between buyers and sellers; and can serve as intermediary when excess supply exists (as a buyer) or as a seller when a shortfall of product exists (when buyer demand exceeds supply).

Trading Process

Typically, traders execute buying and selling electronically, or at a pit exchange. Due to the nature of trading, an experienced trader can help navigate the speculation that comes with the trading process. Just like buying stocks, speculation can cause the price of items to surge and drop depending on market conditions, sentiment, and related news.

An experienced trader can help navigate the waters of buying (importing) and selling (exporting) commodities, and understand the nature of speculation to ensure buyers and sellers get a fair deal. Many large commodity exchanges are found in larger cities around the world, such as New York, Chicago, London, Shanghai, Tokyo, Sao Paulo, Johannesburg, and Sydney.

Summary

Using an experienced commodity trader to represent a business needing to buy or sell commodities ensures a fair contract. When buying and selling international goods, Accord Global Trade can leverage years of experience to help exporters sell their products at the best rate, and importers purchase commodities at the best rate. As speculators can make prices rise and fall, an experience trader can help to navigate the waters when reaching a contract. Interested in importing, exporting, or trading commodities? Reach out to Accord Global Trade today.